Footballers and finances. This rarely proves to be a good combination. Research conducted by the British X-Pro [1] shows that 60% of the top footballers from the English Premier League find themselves in financial problems within five years of their retirement. In 2015, an English Premier League footballer earned an average of £2.3 million (just over €3 million). Such high salaries strangely enough, are apparently not sufficient to provide top athletes with a quiet, carefree retirement.

There are several explanations for this unfortunate phenomenon. First of all, there is the fact that footballers often have little or no financial knowledge, and certainly do not excel at good administration. They also often lack sufficient discipline to control their spending – which becomes all the more difficult in a world full of temptations. One last important factor is their entourage. Often footballers unfortunately seek advice from unscrupulous brokers or intermediaries who are just looking for a way to make a fast buck.

One of the most underrated issues is the preparation required for high quality investments. Footballers who have saved up a tidy sum, often pour too much too quickly on their investments without thorough preparations. . They do not closely examine the nature or the magnitude of their investments, let alone the risks attaching thereto.

In this article, we will focus more closely on a number of essential thumb rules that footballers should follow before actually starting to invest their savings.

Thumb rule 1.Select a reliable adviser/coordinator

Knowing that as a footballer, you have limited financial knowledge, you should ideally appoint a confidential adviser with extensive knowledge of business affairs, who will guide and help you organise all your non-sports related affairs. Someone who will conduct negotiations on your behalf with persons who come to you with investment proposals. Wherever necessary, he may also take up the responsibility of coordinating consultations with specialists such as accountants, lawyers, etc. In this manner, he can assess projects as accurately as possible.

In this manner, you will not only save a lot of time but you will also have better protection. Such a person would assess the risks far better and, wherever necessary, engage experts to better analyse specific risks or to overcome the same. Obviously, he would have a large responsibility resting on his shoulders.

The choice of the correct confidential adviser requires a thorough due diligence. All consultants or intermediaries are not equally competent or reliable. There may be a particular intermediary who is competent in accountancy or judicial procedures for example, but that would not necessarily make him a suitable person to analyse a sponsorship contract. Do not forget that there are specialists in each and every field of expertise. Just as there are defenders and strikers in football, there are criminal law specialists and sports law specialists or VAT accountants and SME accountants. There can be enormous differences in terms of quality as well.

Tip: As a footballer, it would be difficult to assess confidential advisers. It is often more important than the choice of your club or your agent. The quality of the confidential adviser will have a major impact on your retirement. Take your time to appoint a confidential adviser. All too soon, one chooses a confidential adviser from one’s own entourage. Obviously, an existing bond of trust offers advantages, but experience tells us that in some cases it also can cause problems because these individuals often lack the appropriate training and reflexes.

The following example shows how you can best approach the selection of a (financial) adviser.

Example – FIBA Athletes Financial Handbook

FIBA, the International Basketball Federation, has compiled a financial guide. This guide aims to provide support to all FIBA members for many of the possible financial obstacles that a basketball player may encounter in his career. Although this manual is quite brief, it does have a questionnaire that each basketball player can use as a guideline if he wishes to avail of the services of a financial adviser. Use this questionnaire when you appoint a confidential adviser.

- What will your service cost and how will you be paid?

Each consultant invoices for work in his own way. You must know exactly where you stand. If commissions will be paid, will it be a fixed commission or a compensation based on the assets?

- What are your references?

Obviously, this is of vital importance. Holding a specific degree or having completed a particular training does not automatically make you a specialist in a particular field. A brief experience of a few years is therefore certainly insufficient to become a specialist in a specific market.

- What kind of experience do you have?

A consultant may have experience as a lawyer or consultant for wealthy people, but footballers are a very particular kind of clientele. Relevant experience in the sports world is essential. A good question is to request candidates to provide a description of the type of client with whom they normally work.

Also always ask them whom they have worked with (if they are permitted to disclose this) and whether you could speak to them.

- What services do you offer and how often do you meet your clients?

This must be very clear. The services that are offered must exactly match with your needs.

The frequency of contact with clients also quickly gives an idea of how realistic a collaboration is. If you are often abroad due to European competitions and the consultant wants to meet you every week, he must in principle, travel with you everywhere. This is not always realistic or practical.

- Do you have any questions for me?

A consultant must have the capacity to understand your needs and concerns. This can only happen if he asks the right questions so that the objective of the cooperation can be understood and achieved. Possibly, you will need to jointly determine these goals. A consultant who does not ask any questions and does not take into account your specific need, will offer you a standard package. This is not ideal.

Thumb rule 2. Always start with an asset scan

Footballers are bombarded with a vast number of investment proposals. The investment projects offered are also very diverse. In practice, we encounter proposals that range from taking over brothels or “wellness centres” (with remarkable turnover after midnight), opening a sports or clothing store, to more classic investment proposals such as real estate or investments.

Before any investment proposal is actually considered, it is best for each footballer to take a step back and to ask himself: What financial risk can I take on as a footballer?

In order to determine this, you must have an understanding of the scope of your ability and how much you can afford to ‘lose’ in investments. This can be done with an asset scan. Do not worry; you do not have to organise it yourself. Many banking institutions and financial planners offer a scan either free of cost or for a limited fee. But be sure to use this, it is just a little effort that can provide you with very valuable information.

The asset scan provides an overview of the assets that you have built up at any particular moment. Thus, the scan allows you to see among other things, what exactly your assets consist of: the value of your real estate, the value of your savings, investments or term accounts, unpaid taxes, the various insurance policies that you have, an overview of all your outstanding loans or other debts, etc.

The ultimate result of the scan would ideally give you one important figure: how much are you worth? In other words, this would show what your net assets would amount to if you were to sell off all your assets and immediately pay off all your debts. Often, this is far less than what the top athlete expects.

Why is this figure so important for your future investments? If you are offered an investment project, you can then assess whether the risk is justifiable within the larger totality of your assets. For example:if it appears that after deducting all the costs and liabilities, the footballer has €100,000 left over, the risk of a project with 10 million Euros debt is not in proportion to the assets of the top athlete.

An asset scan, combined with a detailed financial plan (see below) is therefore the ultimate basis to know the risks that you can bear, and the investments that would be suitable to you.

Tip: when you are having an asset scan done, you would be well advised to provide the maximum amount of information to the person or the institution responsible for the scan. The more complete the information, the more accurate the asset scan, and the better you will be able to assess your own risk. There are a lot of financial planners in the market who are well suited for this purpose.

Example – statistics and findings of Stirr Associates

Experience teaches us that if you were to have an asset scan performed on 10 top-class football players, and ask them about the amount of their assets, 9 out of them would be unable to answer or their estimate would be totally off the mark.

As soon as we have the results of the asset scan, a number of things come to light. Here are the top 5 findings after carrying out the asset scan for footballers:

- The interest rates for loans are (far) too high;

- There are no contracts for many of the assets that they claim they have;

- The investments and investment products are not sufficiently transparent/clear, and the related costs are excessive;

- The term and repayment for real estate financing is too risky and not in line with the individual requirements of the footballer;

- Some risks are underinsured, while other risks have double or triple insurance.

Thumb rule 3. After the asset scan, have a financial plan drawn up (but do not rely on it blindly)

Now that we know what the assets are worth, we can examine how these assets will evolve in the future. This can be done with the help of a financial plan. The financial plan takes into account your income and expenses and attempts to project them into the future. For this as well, one can rely on financial institutions or financial planners.

Caution: For footballers, it is impossible to make a long-term projection of this financial plan, due to the nature of their employment contracts, which last for 3 to 5 years on an average. The ongoing employment contracts are the only security that you have as a footballer. It is impossible to predict whether these contracts will be worth more or less in the future. This depends on many factors that are not under your control. In case of a serious injury, or if you underperform due to other circumstances, there may be a sharp drop in incomes in your next contract.

Therefore, definitely do not blindly rely on financial plans that are based on assumptions in which you will maintain your current earning level until you retire from sports (mostly around the age of 35). In practice, we even come across financial plans for footballers up to their 65thyear. This is pointless. One cannot always predict the future during and at the end of a sporting career.

The financial plan also has to be modified after each substantial change in incomes or expenses. The financial planner should not only be notified when new employment or sponsorship contracts are signed, but also when investing in a new investment project that is supported by heavy loans. Even the birth of a child or a marriage provide good opportunities to reassess the financial plan. These events have an impact on the assets and the financial plan of the footballer in most cases.

It is therefore essential that a worst case scenario is also drawn up. This scenario provides for an immediate and definitive end to income from sports activities (for example in case of an injury that immediately terminates the career). This will show whether the assets already built up are adequate to support the current rate of spending in the future as well. Often this is not the case. Experience teaches us that the worst case scenario is the real “eye opener” for many footballers.

Tip: keep it simple and ensure that you understand the plan that is placed before you. In practice, we often encounter plans that have several dozens of pages with just figures and complex calculations. Ask your planner to limit themselves to the heart of the matter. The only thing that you really need to find out is the following:

- What are my net earnings per month?

- How much do I spend each month?

- Suppose I have a serious injury tomorrow, and can never play football again, how long would I be able to continue with the assets that I have already accumulated?

- How much would I need if I retire as a footballer, and wish to maintain the same spending level for the rest of my life?

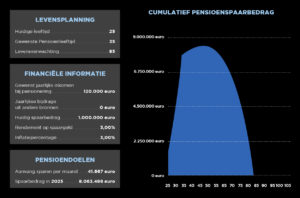

Example – a (rough) financial plan for an existing footballer

The following figure shows a (very) rough financial plan for a professional footballer. As stated, most financial planners use several even more complex financial planning tools. In view of the relativity of a financial plan and its limited usability for a footballer over a period of time, it does not offer a lot of added value.

This figure provides a good overview of the insights that a financial plan can offer, and answers a few key questions. In the present instance, we have a 25-year old footballer who wishes to retire by the age of 35.

- How much do I spend each month?

This footballer spends €120,000 per year (or €10,000 per month).

- What is the value of my saved assets?

This footballer has already saved €1 million.

- How large must my assets be if I wish to spend €120,000 each year after I retire from sports?

In order to have the capacity to spend the same amount after retirement (€120,000 per year), the footballer must have built up assets of a little more than €8 million at the age of 35 – his age of retirement.

The assumption is that the return from the accumulated assets will also cover inflation (normally this earning could/should be higher in practice).

- How much must I save each month in order to accumulate an asset base of €8 million?

In order to build up assets of €8 million by the age of 35, the footballer must therefore set aside €41,667 each month. Taking into account his monthly expenses of €10,000, this would require him to earn a net monthly salary of at least €51,667 for the rest of his career. In case the footballer is no longer able to earn this net salary, he has no option but to reduce his spending pattern.

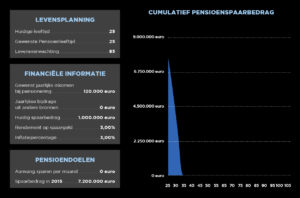

- What does the worst case scenario look like?

The aforesaid figure does not take the worst case scenario into account. As already stated, it is also important to take this into account, and to adjust the financial planning according to this as well. To do this, we must assume that the footballer can no longer collect revenue from sports activities and is therefore required to give up his career as an active footballer.

The following overview now applies:

The findings? The accumulated assets of €1 million will not be sufficient. Based on his current expenditure, the footballer is already a non-runner before his 35th year. However, he had already built up a good asset base of €1 million.

Ideally, the footballer should have already had €7.2 million to enable him to retire with peace of mind. In order to cover this risk (in whole or in part), it is recommended that the footballer should obtain insurance.

The majority of footballers believe that they will enjoy their pension with peace of mind with €1 million, but as the aforesaid figure shows: this is no longer true.

Thumb rule 4. Become an entrepreneur only after your retirement

One of the most important rules of thumb for the majority of footballers is: take up business only after you retire. However successful and brilliant you may be in your athletic career, as a footballer you must understand that you have limitations outside your sporting activities. Limitations not only on how much time you have available, but also limitations as regards talent and experience. In other words, the fact that you excel in sports does not mean that you will also have great entrepreneurial talent.

In addition, entrepreneurship and investing is something that has to be learned. If you want to be really good at something, you should be thinking of investing around 10,000 hours [2]. As a footballer, it is impossible for you to invest all the time you need to invest in your sport, and yet have 10,000 “entrepreneurial hours” to spare. It is unrealistic to expect that you would be able to build up a successful business during your active sports career, unless obviously you have a team that you trust blindly (a team that is also competent as well as efficient). Building up an enterprise on your own is not something that you can quickly fit in amongst a whole lot of other things.

Entrepreneurship also means taking risks. Depending on the standard of living that you want to have after retiring from sports, you will have to put a large – perhaps very large – buffer of financial resources at risk, in order to successfully start a business. It would also be very realistic to assume that you will require these reserves in order to retire with peace of mind for the rest of your life.

If during you career, you decide to invest a substantial portion of your accumulated capital in businesses or projects, this will have an impact on your future standard of living. If things turn out better than expected, there will of course be no problem. In case of failure however, you will often lose the major portion – if not all – of your invested money. Each Euro that you lose during your career in terms of investments is a Euro that you will not be able to use to build up your assets and therefore your pension.

It is therefore better to wait until after your career before you start a business. You will then have sufficient time to select a project that fully meets your wishes and goals. You will also have a better understanding of your standard of living and therefore about the capital that you may possibly be able to risk for your business.

Example – In Good Kompany

Vincent Kompany is a big name in English football. His leadership and footballing abilities are beyond dispute. Apart from football, Kompany has made several attempts to take up business. He invested in a taxi/limousine business, and invested in a Brussels football club. This latest investment had more of a social dimension to it than anything else, and may be regarded as a success in that regard.

One of his side projects was the opening of “Good Kompany.” Good Kompany was a sports bar at expensive locations in Brussels and Antwerp. It is important to realise that running a café is not easy. It is a highly competitive business with a lot of tough competition and low margins. Statistically, there is a very low chance of success. Kompany invested in very high quality locations and as a consequence, his costs were undoubtedly quite high. In order to survive this, you have to be a thoroughly established as a café owner and your bar must be a huge success. Kompany lacked the necessary experience and soon saw that the project was doomed to failure. After barely a year, he closed both the sports bars.

Apart from the investment aspect of the “Good Kompany” project, one can also ask whether this was at all a suitable project for Kompany. Kompany has a carefully built up image of an intelligent, self-conscious – perhaps even somewhat elitist – personality (even if he would not like to hear this himself), with a clear and ethically sound vision of society in general. To open a café on the other hand is a somewhat ‘popular’ activity requiring close involvement with ’common’ people. This would appear to be more in keeping with the personality of say Wayne Rooney, than Vincent Kompany.

Decision

If as a footballer, you are already following the aforesaid rules of thumb before you begin to invest, you are already a good step ahead of the rest. You can assess your risk far better, and you are surrounded by people with a good knowledge of practical affairs. Obviously, there is some cost involved, but this limited investment will only add to your protection.

Please remember:

- Request an asset scan and financial plan

- Provide as much information as possible to your financial planner/consultant

- Appoint a confidential adviser with a broad business knowledge

- Make clear agreements with the confidential adviser

- Only start a business after you retire from sports (or after you are financially sound)

[1] http://www.xpro.org/research/

[2] At least, according to Malcolm Gladwell, author of the book ‘Outliers’.